Beazley plc 2023 group results

Beazley plc has announced to the LSE its group results for 2023

The full Press Release is available here and key financial highlights as below:-

- Record profit before tax of US$1,254.4m (2022: US$584.0m);

- Insurance written premiums increased to US$5,601.4m (2022: US$5,246.3m);

- Investment return: US$480.2m (2022:US$179.7m)

- Undiscounted combined ratio of 74% (2022: 82%);

- Low 80's undiscounted combined ratio for FY 2024;

- Interim dividend of 14.2p and share buyback programme of up to US$325m.

Some other extracts:-

Chief Underwriting Officer's report

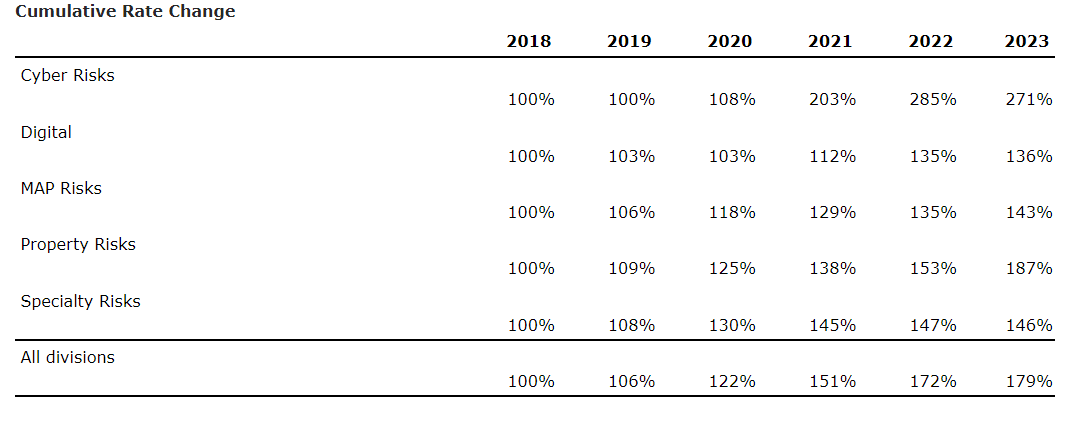

Property Risks has had a particularly successful year with premiums increasing by 64%, taking IWP to $1,351.9m (2022: US$823.2m)..."Beyond substantial rate increases, we have tightened terms and conditions and raised attachment points. Importantly, we have ensured that property values have increased to reflect higher inflation."

Cyber Risks :... "The substantial rate increases of 2021 and early 2022 moderated during 2023 and we expect this trend to be maintained."...."2023 was also the moment when the market began to mature and address the challenges of systemic cyber risk, namely the possibility that a single cyber event or incident might trigger widespread failures and harmful impacts across multiple entities, sectors, or countries. We took a leading position in this with the robust approach we have championed, thus succeeding in bringing much needed clarity to the existing war exclusions. As we enter 2024, we are seeing broad market consensus."

"Active cycle management is at the heart of our underwriting and while the current conditions mean we are leaning into property, in contrast we remain cautious in the D&O market. Here rates remain very competitive and instead we are rebalancing our Specialty Risk business by focusing on niche classes."..."The headwinds in D&O - pricing pressure and high competition - saw us actively pull back from risks we considered unsustainably priced and as a result, D&O reduced from 35% of the division's total IWP to less than 30%."

"Geopolitical uncertainty looks here to stay at least looking ahead for the medium term and this is where our MAP Risks division has a key role to play in helping to keep businesses investing and trade moving. The work of our Marine team in ensuring grain corridors in Ukraine remain open, or our Political Risks underwriters' support for clients' overseas operations in unstable parts of the world, is critical to this effort."

"Our reinsurance (treaty) business also had a successful year with significant rate increases achieved at higher attachment points. As we expected, the US segment of our business experienced the strongest market rating environment."

There is a wealth of information in the Press Release which is therefore worth reading for the full picture.

The analysts slides are available here.

These are going to be well-received results - Beazley's shares rose this morning and are up 18% this month -we await the 2021 Account results for syndicates 623, 5623 and 6107.