Frequently Asked Questions

Answering some of the most frequently asked questions.

What is Lloyd’s of London?

Lloyd’s is the world’s oldest insurance and reinsurance marketplace, located in London. Its members, grouped into syndicates, provide insurance cover to Lloyd’s policy holders around the world. Since Lloyd’s was founded in 1688, underwriters at Lloyd’s, developed the first insurance policies covering motor (1904), aviation (1911), and satellite (1965). Now, in the 21st century, Lloyd’s 3,500 expert underwriters and brokers are devising policies for a more volatile and inter-connected world to enable businesses and communities to manage their exposures to various natural and commercial perils. Thanks to this background and culture of expertise, Lloyd's has built a reputation as the world's leading insurance and reinsurance market.

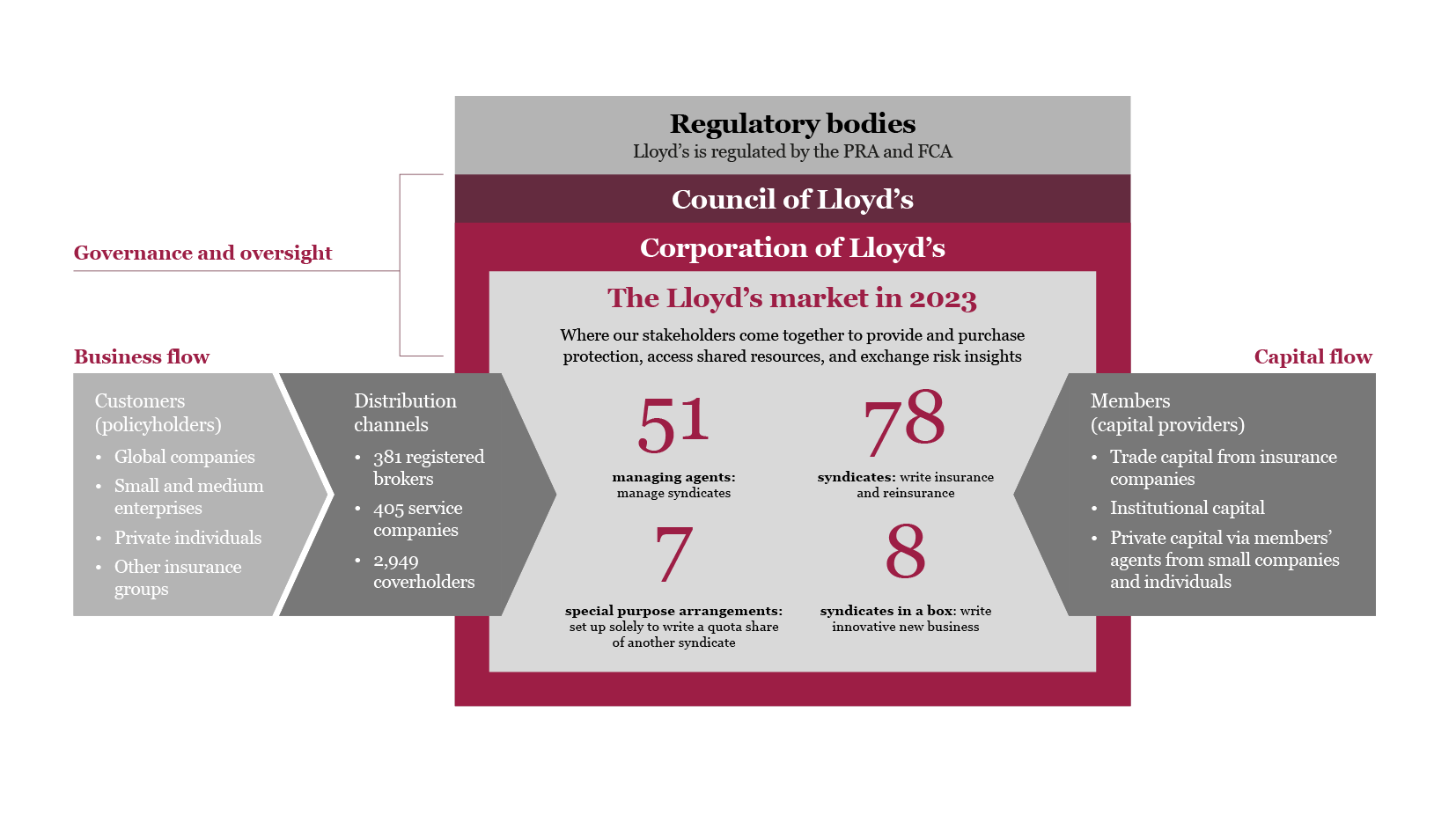

Who runs Lloyd’s?

The Lloyd’s market is administered and overseen by the Corporation of Lloyd’s. It sets the rules and standards, maintains market integrity, and provides the centralised services to support underwriters and policyholders. Lloyd's is also regulated by the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) in the United Kingdom. These regulatory bodies ensure that the market operates in a fair, transparent, and financially sound manner.

What does Lloyd’s insure?

Using years of experience and highly sophisticated technology, underwriters specialise in assessing and managing risk across many classes of business including agriculture, aviation, cargo, cyber, employers’ liability, fine art, personal accident, medical expenses, motor, nuclear, political risk, property, terrorism and many others.

What is an underwriter?

Underwriters are individuals, employed by managing agents, who assess risks and determine the terms and conditions of insurance coverage. They decide whether to accept or decline insurance risks, and set the premiums.

What is a syndicate?

A syndicate is an entity whereby the Members (investors) can pool their capital to support the underwriting of certain types of insurance risks. Each syndicate operates as a separate business unit, sometimes specialising in a particular type of insurance. Syndicates are administered and overseen by Managing Agents. Each syndicate sets its own underwriting capacity and risk appetite, allowing for a diverse range of coverage options and competitive pricing, or hard-to-insure risks.

What is a Managing Agent?

Each syndicate within Lloyd's is managed by a Managing Agent. The Managing Agent is responsible for employing underwriters as well as the day-to-day operations of the syndicate, including underwriting decisions, claims handling, and risk management.

What is a Member of Lloyd’s?

The individuals and corporate entities in the Lloyd’s market are referred to as “Members“. Each Member has a Limited Liability Vehicle (LLV) for which the selected syndicates underwrite.

What is a broker?

Insurance brokers act as intermediaries between the clients seeking insurance and the underwriters. They help clients assess their risks, find suitable coverage in the market, and to negotiate insurance contracts on their behalf.

How does Lloyd’s work?

Lloyd's operates in a unique way known as "open market" or "face-to-face" trading. Underwriters meet with brokers and negotiate insurance contracts. This process allows for direct communication and flexibility in negotiating terms, making the market well-suited for complex and specialised risks.

Who can invest at Lloyd’s?

As well as a wide range of private individuals, their families, family offices and trusts, investors also include the institutional sector such as endowments, foundations, sovereign wealth funds, multi-family offices and retirement funds.

Insurance and reinsurance companies also invest at Lloyd’s.

As a private investor, how much money do I need to invest at Lloyd’s?

Typically, Hampden recommends to private investors that they have total assets worth £10m or more, with the capacity to invest a minimum of £1m in the Lloyd’s market. This does not have to be cash. Existing assets such as equities and gilts can be used, or a bank guarantee. Whatever chosen, the results of underwriting provide a secondary return on the underlying assets.