Californian wildfires - initial thoughts upon these ongoing events

Broadcasters and newspapers are covering extensively the massive wildfires that have broken out across the Los Angeles County, destroying more than 10,000 buildings and killing at least five people and compelled more than 70,000 people to evacuate.

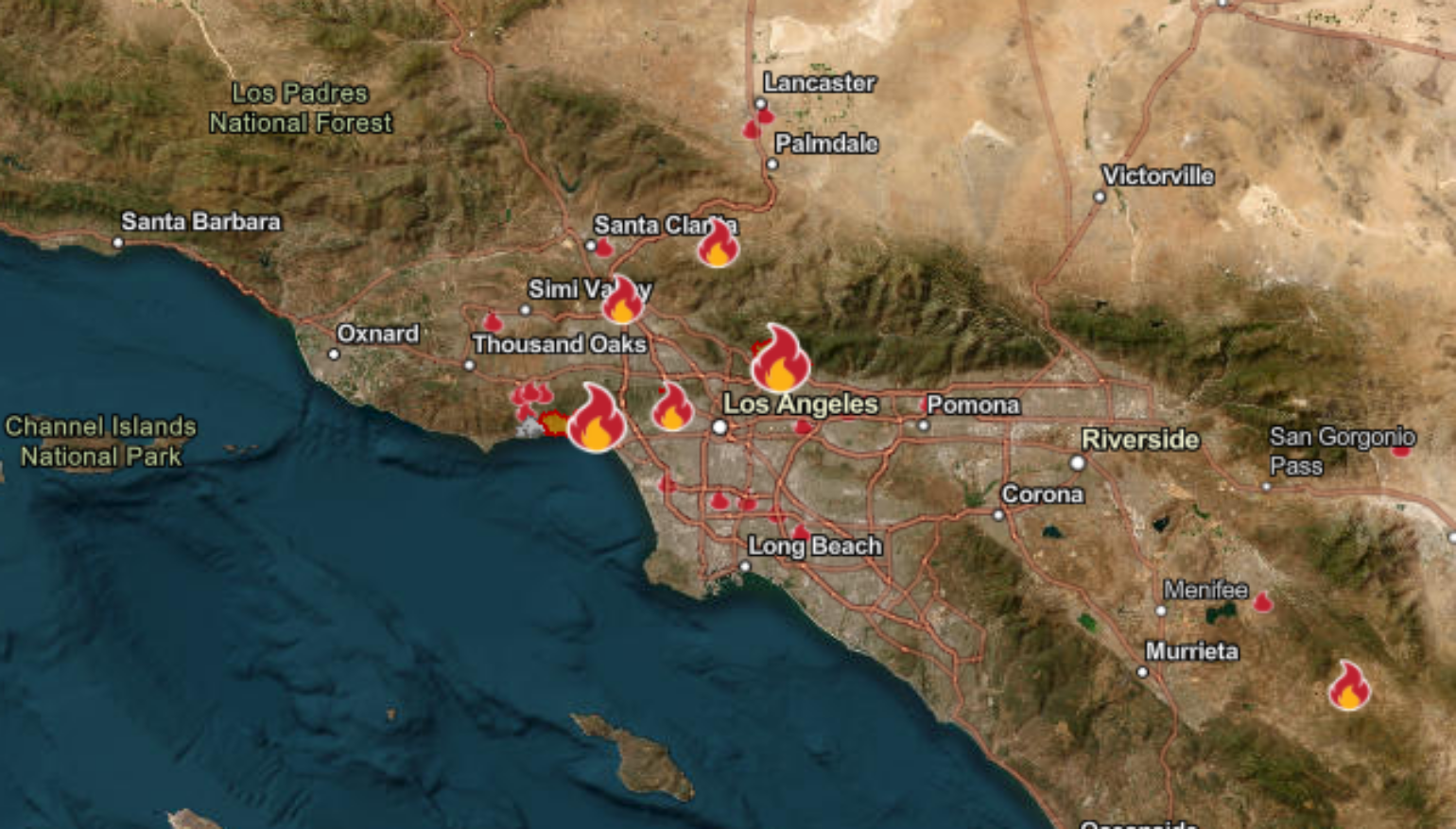

At least four separate wildfires are currently affecting the LA area:-

- Palisades fire, to the west of LA, between Malibu and Santa Monica;

- Eaton fire, centred near Pasadena;

- Hurst fire, San Fernando Valley;

- Lidia fire;

- Sunset fire, Hollywood Hills.

Several of these wildfires are uncontained including the two largest, Palisades and Eaton despite the best efforts of the Californian firefighters, CAL FIRE, which updates currently active incidents here: https://www.fire.ca.gov/

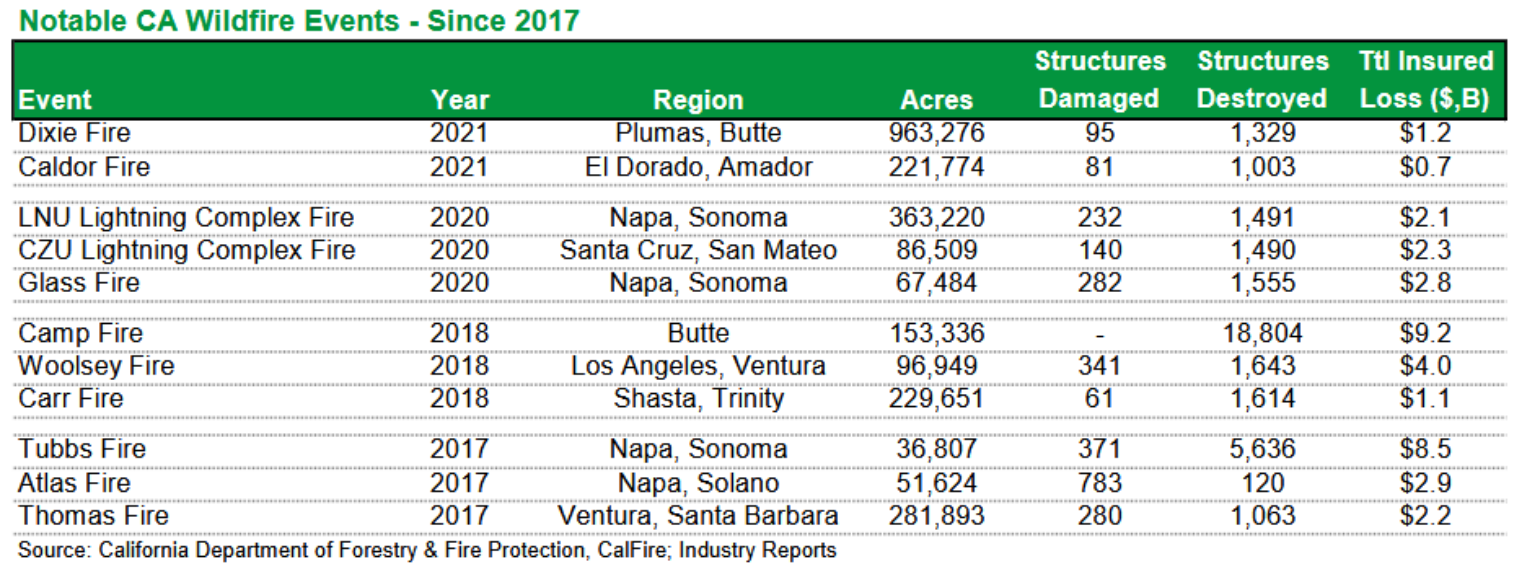

The impact and insured/reinsured cost will clearly be in the $billions with an early estimate of insured losses of $8bn from Morningstar DBRS. Notable California wildfire events since 2017 are headed by the Camp fire in November 2018 at $9.2bn and Tubbs in October 2017 at $8.5bn using data from the California Department of Forestry and Fire Protection. Since then, the market has changed radically with some carriers stopping writing new property policies or exiting the state altogether. Many individuals have had to move to the E&S market to secure coverage or the state run FAIR Plan.

The California FAIR Plan, which is intended as a temporary safety net, has been insuring high risk properties since 1968 and in 2022 had around 3% of the total property market rising to 27% of the market in the highest wildfire risk counties. It has around $6bn of exposure to the Pacific Palisades area alone. In the event of a shortfall in paying out losses the FAIR Plan can impose an assessment on state insurers, proportionate to their property market share of up to $1bn for both residential and commercial claims.

We will talk to various syndicates for their opinion and when more substantive information becomes available we will provide a further update in a Hampden Underwriting Research Bulletin expected next week. Although these fires look to be very serious, the hope is that exposure to these sort of events has reduced since the 2017 and 2018 fires and of course premiums are much higher for insurers and attachment points higher on reinsurance programmes, which should mean that the reinsurance market is not seriously affected.