Lloyd's 2023 underwriting profit doubles

Lloyd's, the world's largest insurance marketplace, announced its Full Year 2023 results this morning.

Lloyd's 2023 results announcement:

- Today's Lloyd's results showcase the best underwriting result in recent history of £5.9bn,

- Investment return of £5.3bn,

- Overall profit before tax of £10.7bn,

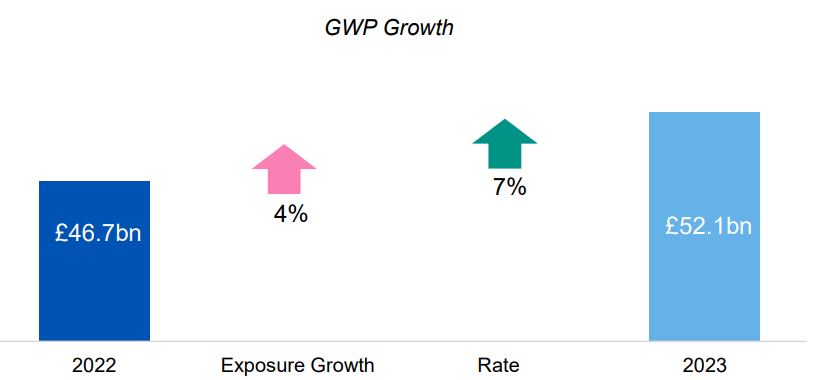

- Increased premium income of £52.1bn,

- A 25.3% return on capital, and

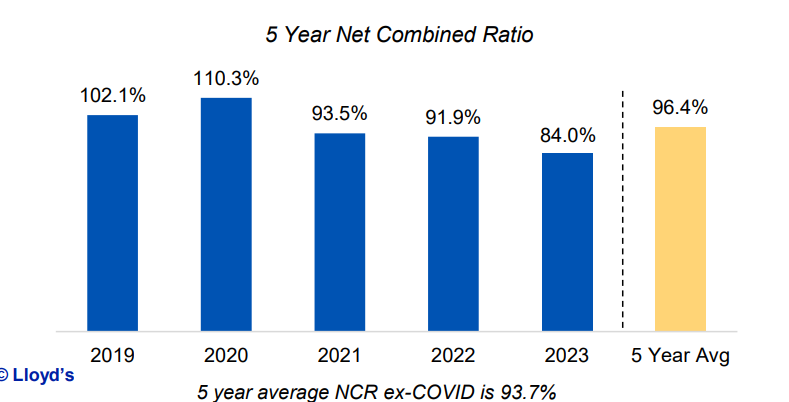

- The lowest combined ratio since 2007.

Lloyd's 2023 results

As these 2023 results show, Lloyd's is uniquely placed to excel during periods of uncertainty and opportunity. Lloyd's Press Release is available here.

The three main financials driving today's results (compared to last year's) are:-

1) Combined ratio at 84% = 8 points better than last year putting Lloyd's amongst the global top quartile (re)insurers:-

The rating agency S&P upgraded Lloyd's from 'A+' to 'AA-' in December last year and Lloyd's expects AM Best to lift their grade too.

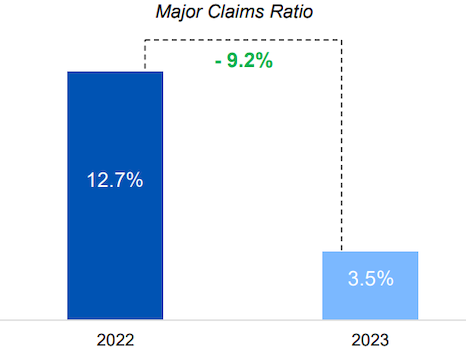

2) A major claims ratio some 9 points better than 2022; 2015 was the last year that saw such a low major claims ratio:-

This was despite the year's catastrophes exceeding US$100bn. The long term average major claims ratio is 11%.

3) Gross Written Premium increased by nearly 12 points over 2022:-

Premium written by the market's syndicates has surged 50% since 2017's premium of £33.5bn.

Lloyd's oversight to be maintained on market's results

The fundamentals driving Lloyd's performance year by year are: capital supply, claims volatility and demand for cover. Lloyd's will keep an eye on measurable shifts in these three factors and not be distracted by "background noise" such as the vagaries of weather patterns.

Lloyd's acknowledges that the 2023 results are exceptional and rightly realises they must not lead to any complacency but instead Lloyd's will concentrate upon sustaining the market's underlying performance, learning the lessons of the past, maintaining price adequacy, reflecting the fundamentals above.

Lloyd's CEO, Burkhard Keese has stated that cost reductions are also in focus for 2024, with an optimised cost and funding structure for Lloyd's Corporation charges with an aim to become simpler and cheaper to operate at Lloyd's. S&P expects a 2-point reduction in expenses over the next few years with the digitalisation and simplifying of claims payments.

Hampden and Lloyd's

Lloyd's number one priorities of underwriting discipline and measured growth will remain at the centre of its oversight of the market, shaping the scale of the market for years to come. In the current outstanding market conditions (average rate increase +58% since 2017) with demand and risk pricing in profitable balance, Lloyd's is determined to deliver solid returns and value for investors in the years ahead and therefore Hampden believes that this is an optimal time to benefit from underwriting returns.

Members of Lloyd's and in particular clients of Hampden have access to high quality underwriting operations expected to deliver excellent profits for the 2022 and 2023 years. 25 consecutive quarters of increased rates has driven growth in Members' level of support of syndicates and with Lloyd's target of double the market's premiums over the next ten years, there will be attractive underwriting opportunities for Members.