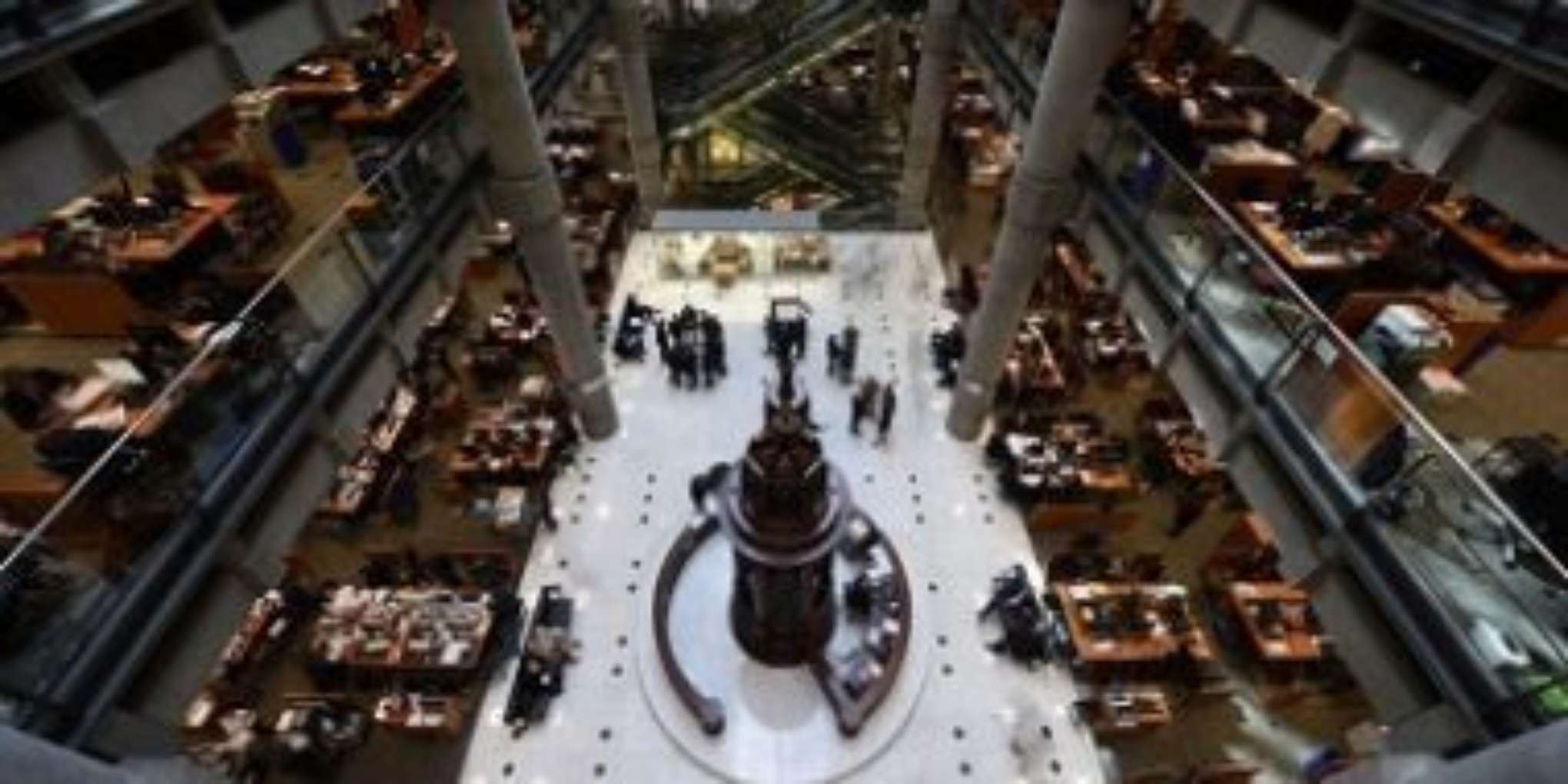

Lloyd's publishes Blueprint 2 for The Future at Lloyd's

Data and technology are planned to streamline the placement, tax and accounting Lloyd's systems for the benefit of the whole market.

Capturing complete and accurate data at the point insurance transactions are entered into will unlock a myriad of benefits for policyholders, brokers and insurers. Brokers and underwriters will be able to benefit from the connected accounting, payment, endorsements, claims, renewals and reporting processes. "This will be truly transformational enabling the market to become a digital marketplace" and lead to a significant reduction in the costs of doing business at Lloyd's with a target of £800m of costs savings.

"We estimate that brokers and insurers could collectively reduce costs by over £800m (representing around a 3% reduction in operating costs) through greater efficiency, reduced bureaucracy and automation. This total is based on research carried out with a sample of managing agents and brokers, looking at their current processes and costs and working out how much these reduce if they adopt all the Future at Lloyd’s solutions. It carries with it two caveats – that market participants adopt the solutions in Blueprint Two and that the current distribution model does not change."

Data

The creation of the core data of each risk from the moment of its binding and encompassing its placement details, tax, accounting, settlement and claims data. The information to be held digitally in the Lloyd's Data Store. This will enable complete digital processing of risks and provide for an enhanced claims settlement process.

"As a consequence of having accurate and complete data within the Data Store, Lloyd’s will be able to reduce the reporting burden on managing agents by automating the reporting requirements to meet local regulatory, tax and financial requirements."

Technology

The future of Lloyd’s technology will enable the creation of a modern, digital, easy to access marketplace, improving market and customer experience, driving innovation, and ensuring the seamless flow of information across the end-to-end value chain.

"Given the complexity of our market, transition will be done in a measured way over time starting within the next two years. Building the most advanced insurance marketplace in the world will require new skills and ways of working in order to be successful. Our collaborative approach will be based on making the most of the world renowned talent we have in the market and also bringing in new, world leading talent and skills. Our approach will be people-centric, open, inclusive and transparent – building the future culture of the market as well as the systems and processes."

A video highlighting the key features is available here

The complete Blueprint 2 document is available as a download here

As the Blueprint comments: "A lot has changed since the publication of Blueprint One. The world is now a very different place and, despite great adversity, the market has responded well and has proven its resilience in remarkable ways. The pandemic has demonstrated that we can adapt and do things differently and, if anything, has only increased our ambition for what the market can achieve."