Lloyd's publishes official 2024 year results

Lloyd's has published the final 2024 year results for the market.

Our previous article about the 2024 preliminary Lloyd's results available here refers.

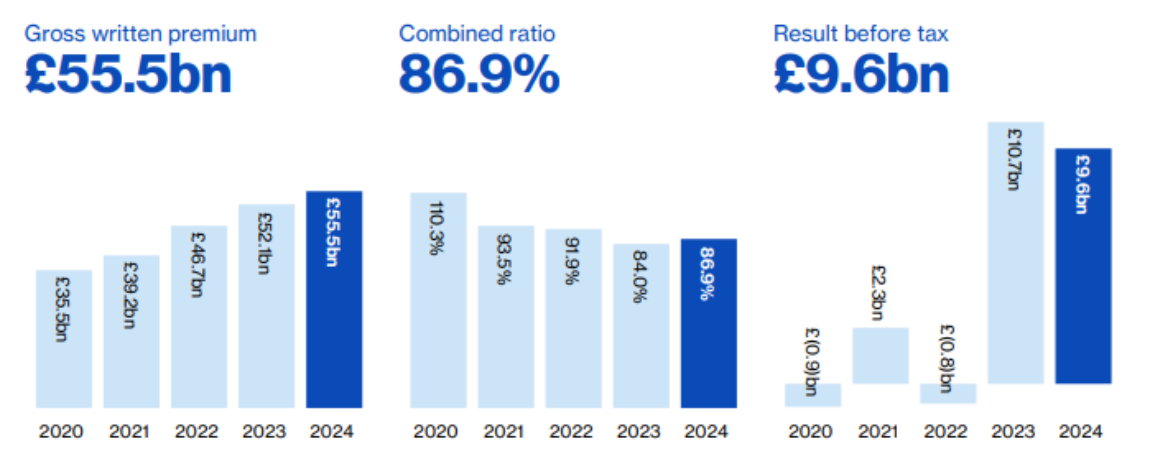

Full copy of the Press Release available here and the key figures reported in Lloyd’s 2024 full year results are:-

- Gross written premium of £55.5bn (2023: £52.1bn)

- Underwriting result of £5.3bn (2023: £5.9bn)

- Combined ratio of 86.9% (2023: 84.0%)

- Underlying combined ratio of 79.1% (2023: 80.5%)

- Profit before tax of £9.6bn (2023: £10.7bn)

- Attritional loss ratio of 47.1% (2023: 48.3%)

- Investment return of £4.9bn (2023: £5.3bn)

- Total capital, reserves and subordinated loan notes of £47.1bn (2023: £45.3bn)

- Central solvency ratio of 435% (2023: 503%)

A chart below extracted from the 2024 Annual Accounts illustrates some of the above:

Source: Lloyd's (2024)

John Neal, CEO of Lloyd's said “The Lloyd’s market has delivered another year of outstanding financial performance, with a superb combined ratio, underlying combined ratio and attritional loss ratio supporting a capital position and claims reserve strength that is as strong as it has ever been.

This excellent result demonstrates the market's ability to deliver sustainable and attractive returns for investors, and provide solutions to protect our customers' balance sheets. I would like to congratulate members of the market for their disciplined underwriting and profitable growth and thank Corporation employees for their commitment and support in 2024.”

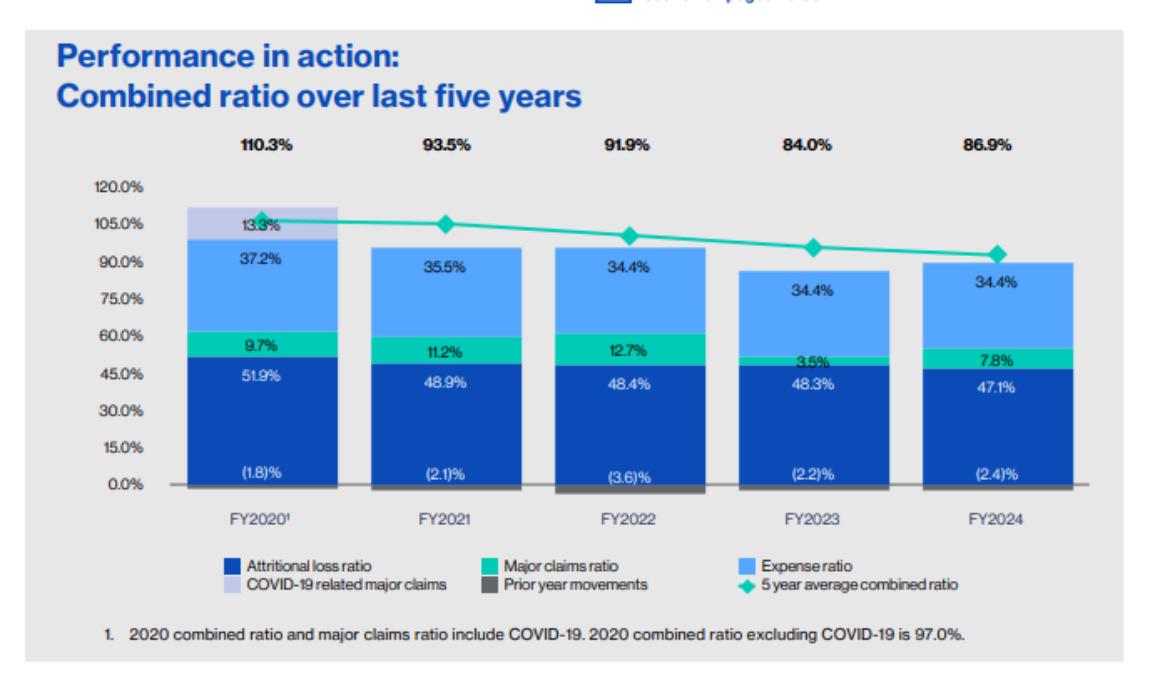

The Combined Ratio improvement is illustrated in this chart taken from the Accounts:

Source: Lloyd's (2024)

The Lloyd's Annual 2024 Report is available on the Lloyd's website here.

We will be sending out Members' individual 2022 Account final forecasts very shortly accompanied with the updated 2023 Account forecasts. The former is not the net cash result; this will be sent to each Member at the end of April, in line with the usual annual timetable.

Please click on the link below to view the recent Market Message delivered by Patrick Tiernan, Rachel Turk and Emma Stewart. Alternatively a copy of their slides is available here.