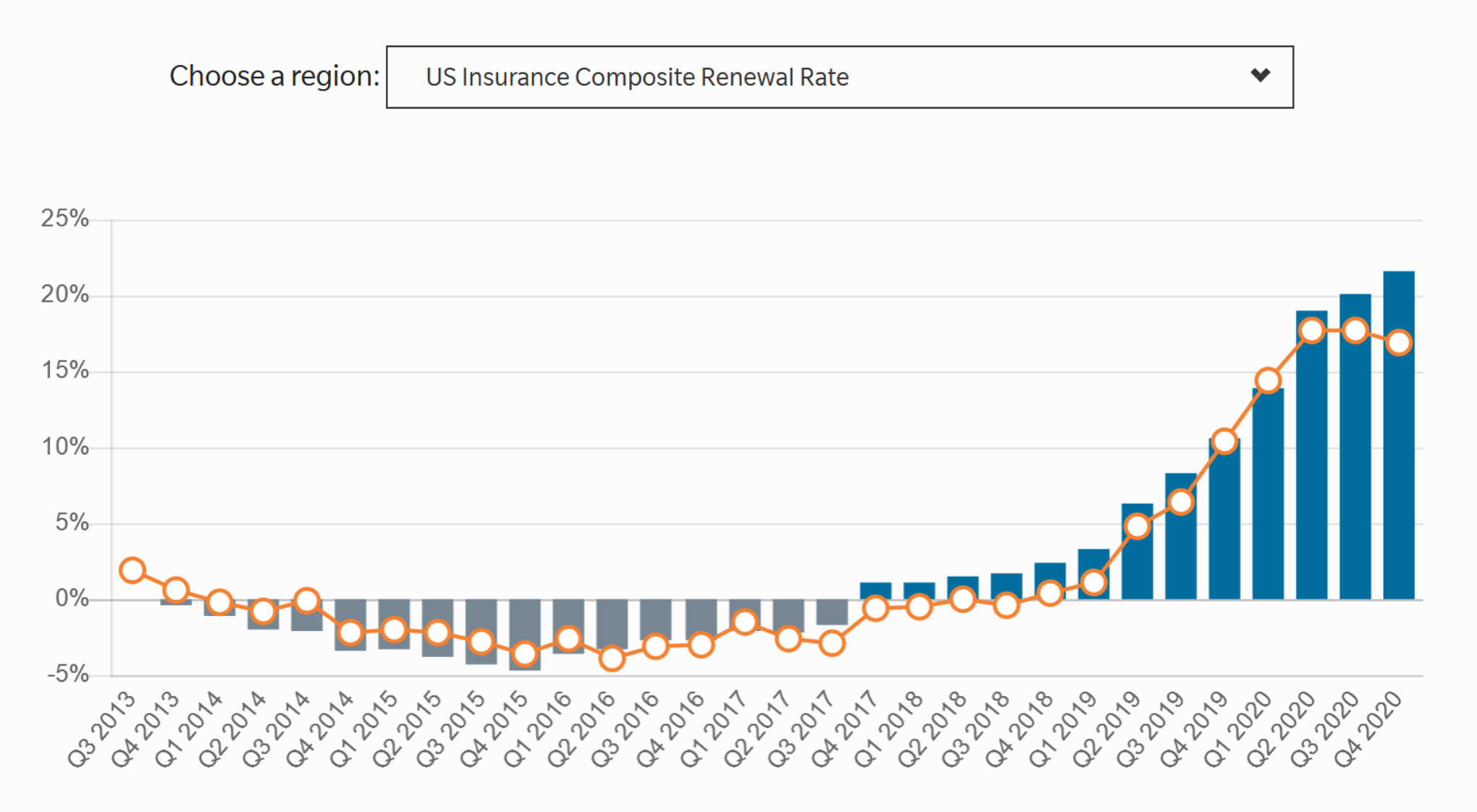

Marsh releases Global Insurance Market Index as at Q4 2020

According to the data in the latest survey from global broker Marsh covering property and casualty insurance renewals, prices rose by some 22%, once again, the largest increase since the index was launched in 2012.

The full report is available here

Extracts from the report as follows:

| Property | Casualty z | FinPro zz | Composite (all) | |

| Global | +20% | +7% | +47% | +22% |

| US | +19%1 | +9%2 | +28%3 | +17% |

| UK | +24% | +6% | +90%4 | +44% |

1 plateauing but not in all industries such as heavy manufacturing

2 excluding workmens’ compensation (not written at Lloyd’s) pricing +15% and on an excess of loss basis +28%. Earlier years’ worries and high jury awards being the drivers.

3 Very much driven by D&O pricing

4 Very much driven by D&O pricing, cyber increased 25% to 30% due to increased claims

Z Employers' and general liability for example

ZZ Professional Indemnity, E&O and D&O for example

This report highlights that insurance risks have led the way in rate increases. See the recent HUR Market Outlook for our views about the trend of rising prices being set to continue.