Q4 2024 Market Message

Lloyd’s 2024 Q4 Market Message

The video and slides are available here on Lloyds.com. Lloyd’s speakers: -

- Patrick Tiernan, Chief of Markets

- Emma Stewart, Chief Actuary

- Peter Montanaro, Market Oversight Director

The Five Key Takeaways – “Discipline is paramount”

- Sustainable profitability remains Lloyd’s key primary performance criteria;

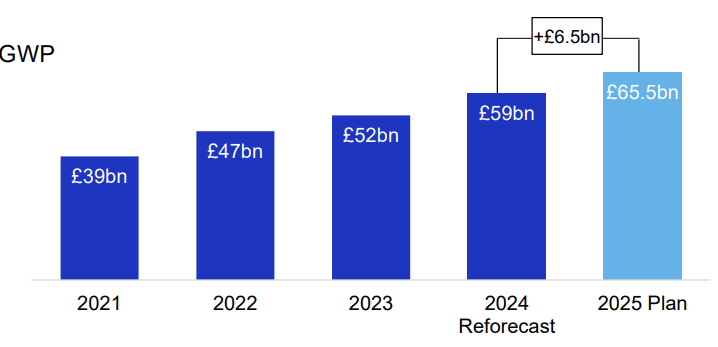

- 2025 plan GWP £65.5bn; growth of 11%;

- More cautious underwriting outlook;

- Be disciplined, be dynamic; get on top of delegated business now;

- No top line growth targets just top quartile performance ambitions.

These explained further with extracts of the speakers’ comments, as follows:-

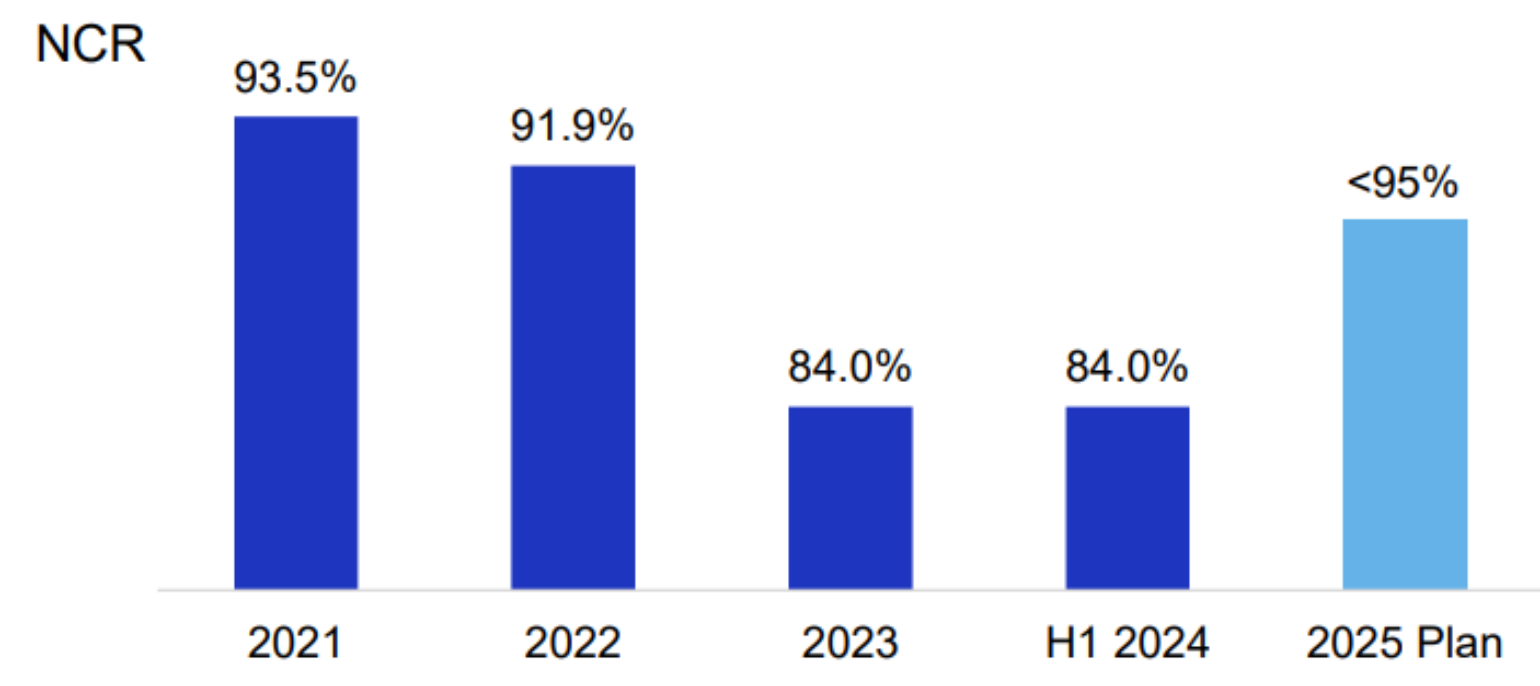

Lloyd’s GWP plan for 2025 £65.5bn – up 11% (or £6.5bn) on 2024 – with the market’s expected combined operation ratio target comfortably below the market’s benchmark of 95% with expected profitability and returns just slightly lower than 2024 plans.

This point in the cycle particularly needs disciplined management of delegated authority business (such as binders) and expenses. Some irrational pricing by a very small minority of Nth USA property binders.

Current market conditions are favourable but more competitive conditions in an elevated risk environment; with heightened risk, customer demand continues to expand. Material increases in capital are primarily coming from retained earnings. All in all, Lloyd’s view is that the market fundamentals will not alter materially in HY1 2025, absent external shocks.

2024 forecast results are achieving target returns on capital metrics against a year of moderate large losses and cat losses for most: hurricanes Helene and Milton - Lloyd’s expected exposure trending towards the lower end of between US$1.8bn to US$3.4bn net. Re-forecast 2024 GWP of £59bn lower than plan by 5% “driven by sensible retrenchment”.

Patrick Tiernan more cautious about the market than he was 12 months ago with rate momentum and rate adequacy and aggressive trading challenges pressuring sustainable growth in property, casualty and specialty lines respectively: -

Property – not seeing notable changes in attachment points or terms & conditions, Lloyd’s expects the positive risk adjusted rate change (“RARC”) as seen in property reinsurance in 2024 will be at least flat for 2025; direct and facultative (“D&F”) property more of a “mixed bag” showing discipline in the face of return of US competition; there was some negative movements in open market property in Q3 pre Helene and Milton; Lloyd’s expects for next year that the 2024 hurricanes activity will ameliorate any broad-based D&F property rating pressures.

Casualty – in Lloyd’s GL US book, they continue to see reduced line sizes but Patrick opined that neither prior year reserve deterioration nor settlement-driven claims inflation in Lloyd’s view not yet being adequately reflected in pricing, structure or terms; so Lloyd’s will require syndicates to demonstrate a robust underwriting approach in this class.

Specialty – Lloyd’s watching “erratic trading on the fringes” which is mostly outside Lloyd’s. No need to intervene yet.

Ambition for market – Patrick said that Lloyd’s has no top line growth targets for the market: it is sustainable profitability that remains Lloyd’s chief primary performance criteria. Syndicates need to focus on delivering top quartile performance against peers as this will ensure Lloyd’s can achieve its sub 95% combined ratio cross-cycle target.

Expanding significantly in a flat rate environment would require adding more top quartile underwriters or top quartile classes of business to the “band”: “We are not going to achieve the symphony of profit and growth by banging the same instruments louder.” Going forward, the focus on disciplined underwriting will be more notably robust in 2025.

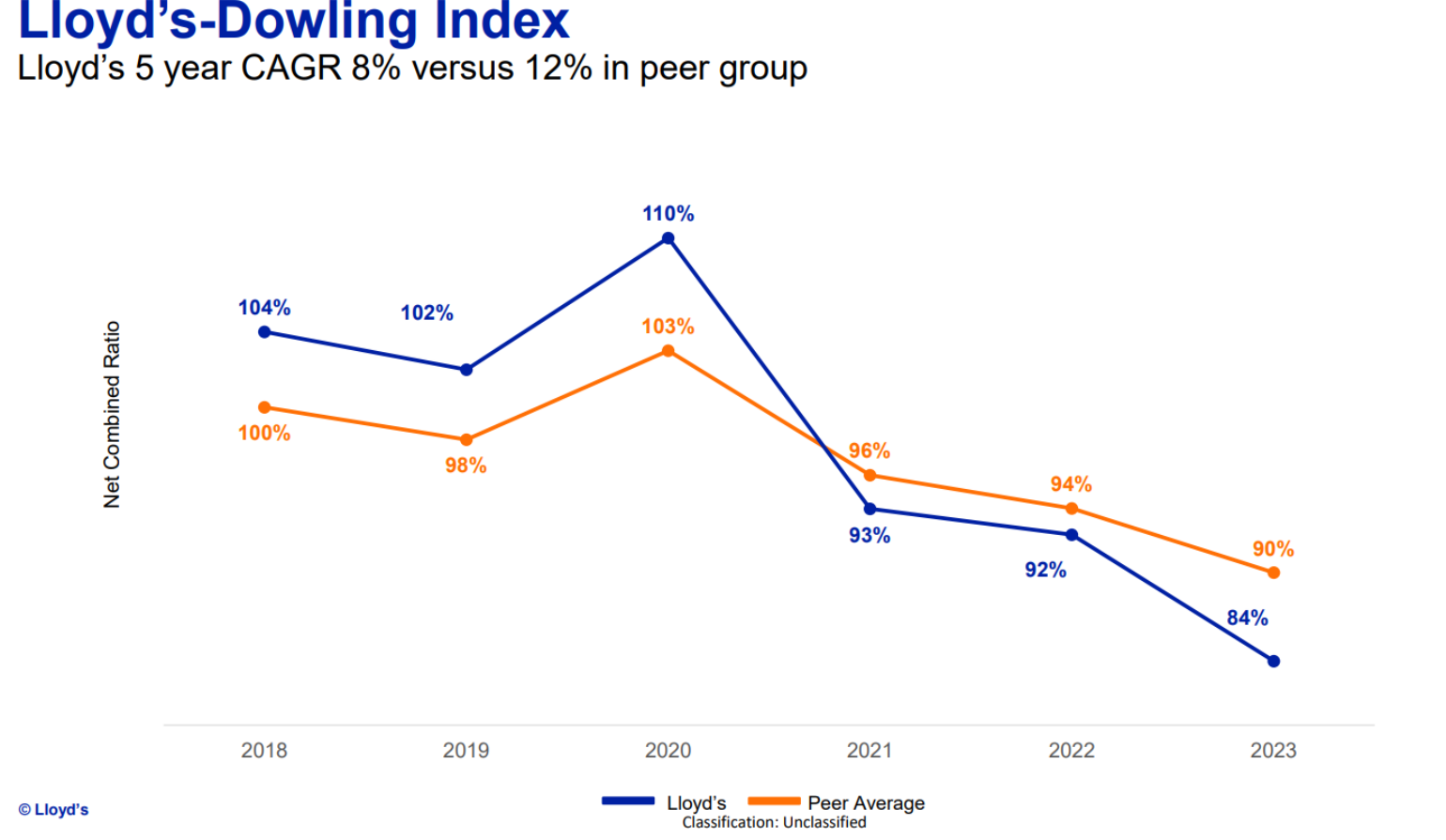

An independently produced “Lloyd’s-Dowling Index” benchmark compares Lloyd’s with other global (re)insurers and specialty players and in the last three years, Lloyd’s has according to the index, grown in a disciplined way (8%) and outperformed its peer group in each of the last three years 2021 to 2023:

Delegated authority (DA) business – particularly an area at this point in the cycle in which discipline needs to be applied consistently. Lloyd’s DA is 39% of GWP and its growth has outpaced open market growth over past three years – particularly property – but one of reputational risk if not properly underwritten or controlled. Dynamic management of the portfolio is now possible compared to past years of challenging conditions. Lloyd’s will downgrade or if necessary remove permissions to underwrite DA. Lloyd’s will not watch from the side-lines if poor underwriting or poor controls exist as Lloyd’s does not want to have take market-wide action again.

Emma Stewart (Chief Actuary) then spoke about “Capital Outcomes and Reserving Expectations” and their importance in managing volatility. Current capital levels 47% of exposure for 2025. Lloyd’s has focussed on the credit taken in capital models’ credit for underwriting profitability. In order to enhance capital oversight, Lloyd’s will look into an alternative approach for new syndicate entrants and also provide a deferred review for aligned syndicates.

After some years’ experience, concern about US General Lability (GL) reserves not a surprise – 2019 and prior has experienced material claims deterioration driven by heightened claims inflation (specifically legal system abuse and nuclear verdicts) but there is some confidence as US GL is a small part of Lloyd’s at 15% of casualty reserves, and Lloyd’s syndicates have a robust reserving philosophy, UK GAAP accounting leads to a higher margin above the best estimate of claims, and previous years’ remediation of the book. In conclusion, syndicates should listen to their actuaries to better analyse underwriting, pricing, capital, and ultimately profitability assumptions.

Patrick wrapped up after listing the five key takeaways of this Market Message with thanks for generally received kind words during his period of recovery.