Swiss Re reports level of 2020 economic and insured losses

At this time every year Swiss Re's Institute releases a tally of the level of uninsured and insured losses. Swiss Re's press release on the report is available here.

Key points are:

- Level of economic losses from man made and natural catastrophe losses of US$187bn up 25% on 2019;

- Level of insured catastrophe losses US$76bn (up 40% from 2019) mostly from secondary peril events such as severe convective storms and wildfires in the US and wildfires in Australia and the US;

- Level of man made losses at US$7bn;

- Very active hurricane season with record number of named storms (30) but only moderate insured losses of only US$20bn compared to 2017 (Harvey, Irma and Maria: US$97bn) and 2005 (Katrina: US$87bn);

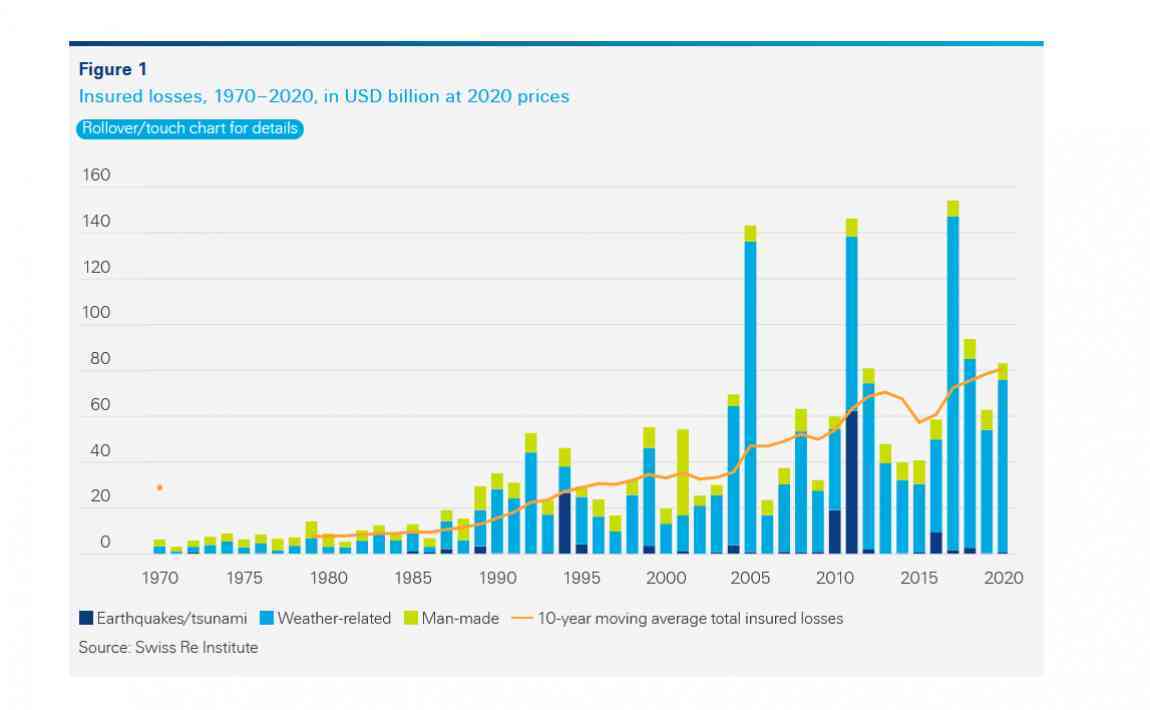

- Total tally of insured natural catastrophe and man made losses puts 2020 at 5th-costliest year for the industry since 1970 - see chart below;

- The insurance industry covered 45% of the global economic losses in 2020, above the ten-year-average of 37%.

Swiss Re Institute will publish updated 2020 loss figures in a full sigma report in Spring 2021.

Global economic losses from catastrophe losses can greatly exceed insured losses - particularly in less developed insurance markets. The differences in the level of insured losses between similarly devastating catastrophes such as the Japanese typhoons and those occurring in the Philippines, India and Bangladesh are striking. As AIR Worldwide's recent 2020 report mentions "The sizable difference between insured and economic losses—"the protection gap"— represents the cost of catastrophes to society, much of which is ultimately borne by governments."

In fact though, even in developed insurance markets such as the US, the difference between insured and insurable losses is significant as we saw with US flood damage following hurricane Harvey.