Willis Re update on 1 April renewals

Willis Re's report on reinsurance renewals "The Perils of Unmodeled" reported that loss-affected areas such as Japan (for wind risks following the typhoons of 2018 and 2019) and US nationwide renewals (following Uri) saw rate increases, as follows:

- Japan for wind and flood perils and catastrophe loss affected: +15% to +20%

- US Nationwide catastrophe loss affected: +10% to +25%

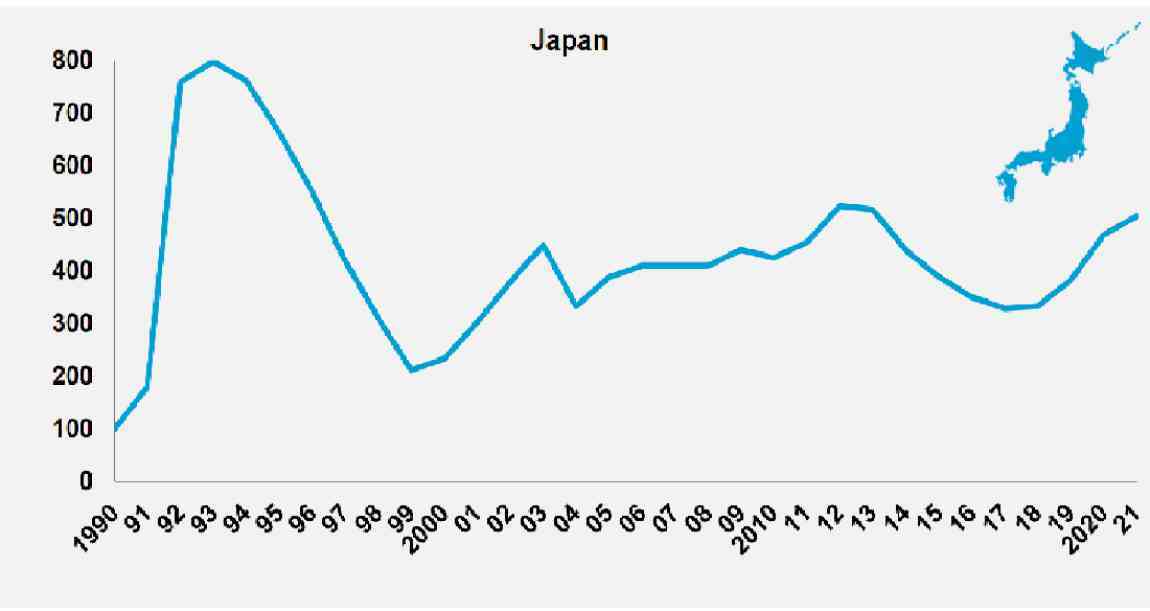

Japan property catastrophe renewals chart 1990 to 2021 - estimated year-over-year property catastrophe rate movement:-

Source: Willis Re. 1990 = 100

The chart above shows that property catastrophe rates for Japan are now in line with 2012/2013 levels following significant rate increases last year.

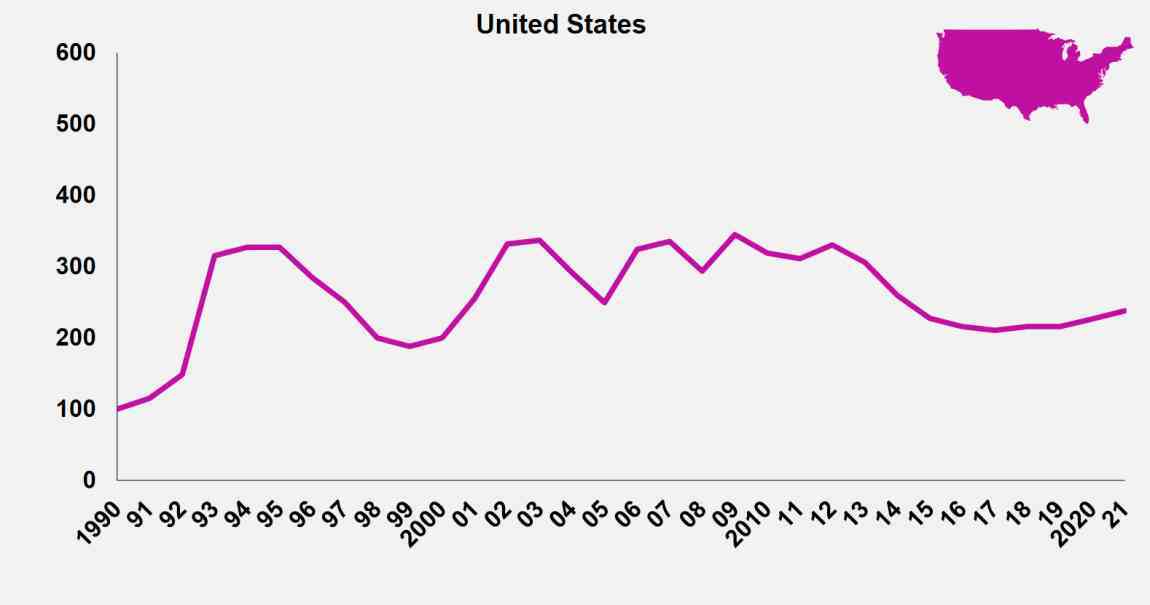

USA renewals

US property catastrophe renewals chart 1990 to 2021 - estimated year-over-year property catastrophe rate movement

Source: Willis Re. 1990 = 100

The full Willis Re report which is available here as a pdf comments that for both these territories capacity was either ample or supply was strong and so upwards pressure on rates was mitigated somewhat.

James Kent, CEO of Willis Re, in his introduction to the report, summarises the situation in this way "Against this background,market pricing remains firm in virtually all classes and territories. Although rate increases in some areas were lower than reinsurers were targeting, the upward direction in rate has led to solid improvements across reinsurers’ portfolios, building on what was achieved at 1.1.2021.

Further assistance for reinsurers has come from the robust underlying growth of ceding companies’ premium incomes driven by a combination of increased demand and rate increases on several primary classes of business."